“Oh, you better watch out, you better not cry. Better not pout, I’m telling you why: the tax man is coming to town . . .”

Okay, I know that’s not how the song goes. And I know the arrival of Santa is much more joyfully anticipated than the metaphorical coming of the taxman. It is after all, more blessed to receive than to give – at least in this context. But we are now in what is known as “tax season” (“To everything there is a season,” as it says in Ecclesiastes 3?). Which means that millions of us are negotiating the impossibly complex world of the US tax system to file tax returns (or extensions) by April 15th.

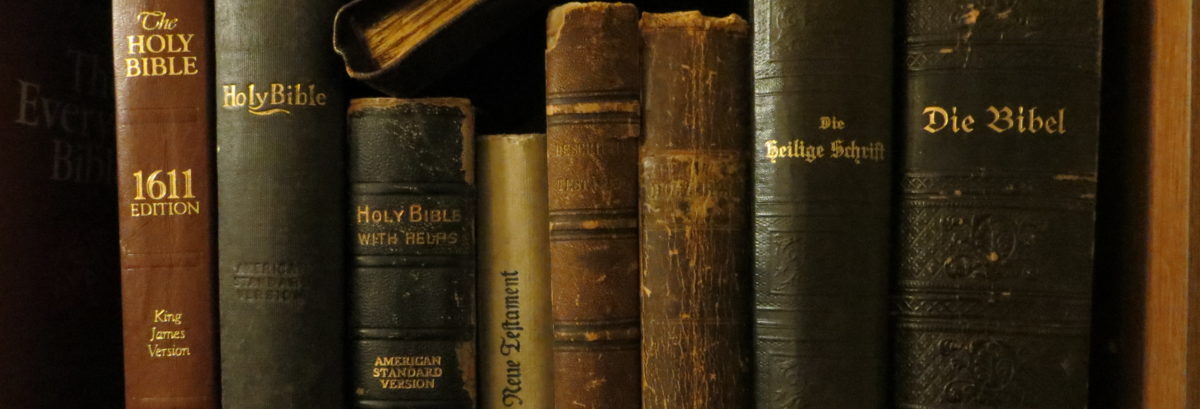

It’s not that paying taxes is wrong; the Bible tells us that it is proper we pay what we owe. When Jesus was asked whether it was right to pay taxes to Caesar, he pointed to the image of Caesar on the coin and commanded famously, “Therefore render to Caesar the things that are Caesar’s, and to God the things that are God’s” (Matthew 22:15-21). Later, Paul said, “For because of this you also pay taxes, for the authorities are ministers of God. Pay to all what is owed to them: taxes to whom taxes are owed . . . ” (Romans 13:6-7). And apart from paying the imperial taxes levied by the Romans, every Jewish man over the age of 20 also paid an annual half-shekel Temple tax to support the upkeep of the Temple. Throughout history, the words of Ben Franklin have been true: “In this world, nothing can be said to be certain, except death and taxes.” (By the way, Ben died five months after writing that. I wonder what his estate tax was?)

It’s not so much that taxes are wrong; after all, someone has to pay for the protections and services that governments provide. But there are problems with our taxes, which make the annual April 15th deadline so unpleasant.

First, there is the complexity of our system, or should I say, systems. There are local, state, and federal tax codes and requirements. The federal code alone is over 10 million words and 71,600 pages long. It is so complex that no one really knows what all is in it: when people call the IRS to get help with tax questions, they get different answers depending on who answers the phone. Entire industries of tax preparers, attorneys, and software engineers exist solely to help people and companies navigate – and pay – the right amount of taxes.

This hit home recently while Karen and I were preparing our tax returns. After careful reading I learned that we cannot claim our cat as a dependent. Nor can we claim cat litter as a medical expense, though it would make us sick if we didn’t scoop or change it often. Similarly, I cannot deduct my haircuts, even though keeping my hair at a good length is a community service: I am helping to keep California beautiful by doing so. At the very least, this blog should be a charitable deduction; it is after all, non-profit. But I won’t try slipping anything past the IRS – they have guns and prison cells, after all.

Second, there is the vast amount of government waste of our taxes. One sore point we have about paying the taxes we pay is that so much of it is wasted in corruption, boondoggles, bad choices, and political favors. There are so many inefficiencies, duplications, and overpriced purchases, not to mention the billions of dollars that just vanish without a trace. This is not just the loss of money – it is the squandering of human effort, labor, and resources which are taken from us “for the greater good,” but which never get used for what they are intended to help.

Just a few examples, courtesy of The Waste Report*: $50,000 given to the Georgia Christmas Tree Assoc to run commercials promoting Christmas trees at Christmas; $158 million in federal lunch money diverted by LA schools to pay for lawn sprinklers and TV station salaries; $188,000 to study why Americans don’t want to use the metric system; over $250,000 for Pakistani kids to visit Space Camp and Dollywood; and $15 million to study the effectiveness of golf equipment in space. Seriously.

Even when our tax money is spent where it is supposed to be, we have to wonder whether the programs we fund actually accomplish what they are supposed to. And this is an issue regardless of one’s political leanings, because the benefits of spending as much as we do in any area can be questioned, whether it is for welfare, farm subsidies, the military, or education. If we knew that every cent we paid was doing some good, we probably would feel better about paying what politicians call our “contributions.” But we know it’s not.

Third, there is the conflict between what is Caesar’s and what is God’s. The third level of disquiet I have when it comes to taxes is with the conflict between what government demands and what God demands. I will gladly render to Caesar what is his, but if it conflicts with what I owe God, then there is a problem. Here I am thinking about a range of things: the funding of abortions and abortion providers; the persecution of Christians who stand up for their faith in the workplace, in school, or in their businesses; government agencies suing people for following their consciences when baking wedding cakes; the denial of tax-exempt status to religious organizations; the carrying out of wars and assassinations for political reasons; and the censoring of speech by government-funded colleges.

I could cite many examples of this God/Caesar conflict, but my point is not to argue over specific cases but to address the bigger question: what if Caesar commands me to do something, or to fund something, that is in direct conflict with what God commands? Here are some thoughts to consider:

-

- The physical and spiritual realms overlap. We can’t just divide things neatly into two piles, one for spiritual activities such as worship, prayer, fasting, and scriptural study, and the other for secular things such as school, work, sports, and taxes. Jesus always directed us to the spiritual application of every area of life. He didn’t say to withdraw from the world like a hermit, but to be active as God’s children in all we do. This makes it harder to divide Caesar-things from God-things, but that’s just the point: everything belongs to God ultimately, and the way we act toward everything in our lives is how we are acting toward God. Do we care for the poor and oppressed? Then we are caring for Jesus (Matthew 25:40). Do we “work heartily, as for the Lord and not for men” (Colossians 3:23)? Do we approach all areas of our lives with thankful hearts, seeking to please and honor God by what we do? If so, then we have to view our relationships to the governing bodies in our lives in terms of how God would view our actions.

- God himself has instituted all authority. He has done so to establish order, restrain evil, and ensure justice (Romans 13:1-4). Likewise, Peter commands us, “Be subject for the Lord’s sake to every human institution, whether it be to the emperor as supreme, or to governors as sent by him to punish those who do evil and to praise those who do good. For this is the will of God, that by doing good you should put to silence the ignorance of foolish people. Live as people who are free, not using your freedom as a cover-up for evil, but living as servants of God. Honor everyone. Love the brotherhood. Fear God. Honor the emperor.” (1 Peter 2:13-17). How we act toward authorities shows how we act toward God, for he is the Supreme Ruler over all, and our actions and attitudes are visible witnesses to the world. Therefore, we are to respect the people who serve in government and treat them as people who themselves have duties to perform.

- We are part of the problem. In our country (and state and city), we have a role as citizen-voters to speak up and vote our consciences. Too long too many good people have sat back and allowed others to make bad governing decisions. Too many times we have just shaken our heads and said, “Isn’t that terrible!” and just gone back to our own selfish pursuits, rather than standing up and speaking out. We hear about “activists” who shape public policy and the use of taxes; why are we not as active in voicing our concerns? When our forefathers rebelled against British rule, one of the main issues was “taxation without representation.” Now we have representatives whom we elect, but are they representing our values? Not if we don’t speak up. Likewise, how many of our voices have been “bought” by politicians through government payments, grants, and subsidies? It’s hard to speak out against misuse of money when some of that money goes back into our pockets.

- At some point, we may need to just say “No.” God’s law is greater than man’s, and there may be a point when obedience to God means saying no to government demands. Shadrach, Meshach, and Abednego refused to bow down to Nebuchadnezzar’s golden statute (Daniel 3). Daniel refused to cease praying to God in spite of Darius’ forbidding it (Daniel 6). John the Baptist was imprisoned and executed for speaking against the ruler named Herod, and Peter and the Apostles were arrested and beaten for speaking about Jesus (Acts 5). And so on. Throughout history, Christians have suffered persecution and martyrdom for refusing the commands of anti-Christian rulers to deny Christ and worship the approved gods. We may face the same dilemma: do we keep quiet and go with the flow, or do we stand up for what we believe. Before we do, there are certain criteria we must take into account if our protest is going to be God-honoring.

What are those things? Tune in next week for Part 2 of this article . . . In the meantime:

May the Lord bless you and keep you, the Lord make his face to shine upon you and be gracious to you, the Lord lift up his countenance upon you and give you peace. Amen.

Read: Daniel 6, Acts 5:17-42

*The Waste Report, issued annually by Sen. Rand Paul.

Taxes – another way God helps me remain humble. And thank you, Pastor, for reminding us of so much more relevant Biblical truth on the matter. May God bless you and your household…and the kitty.

Amen

In Christ,

Todd and Emily